Pips in Forex Trading Explained

Brokerage https://g-markets.net/ in your country are provided by the Liteforex LTD Company (regulated by CySEC’s licence №093/08). IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

It uses the fourth number after the decimal to determine the pip. So, if the difference between prices is 0.0002, the trader will have generated 2 pips. Forex trading is based on the price changes of the currency pairs. And the most popular method of calculating those changes is via pips. The reason for that is instead of the actual value in a currency, pips represent the changes in units which then can be easily transformed into different currency values.

FAQs on pips in forex

A quote for the yen normally extends two decimal places past the decimal point. So, a single whole unit pip is .01 rather than the .0001 for other currency pairs. Pips are very important in forex markets because price movements are constant and fast-paced, so pips are needed to track these movements to a fine degree of accuracy. If the combined position sizes are too large and a trader experiences a string of losses, they could wipe out their capital.

Find out everything you need to know about pip values in forex. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Pips in forex trading are used to measure gains and losses because, a lot of the time, the volatility in exchange rates is on such a minute level that pips make for an appropriate measurement. PIP is the slightest price movement in currency exchange rates.

What are pips in Forex trading?

Now that we know what pips in Forex are, as well as their variations, and how to measure them, let’s see how to actually calculate their value. As mentioned earlier, service providers usually calculate the values automatically, however, knowing how it is done is still useful. Now that we are clear on what a pip is let’s see how much money we can gain or lose for each movement. It’s often challenging to count pips in Forex, but it’s crucial for your strategies and plans. Most brokers do this for you, but you can also use online calculators to make it easy. Trade up today - join thousands of traders who choose a mobile-first broker.

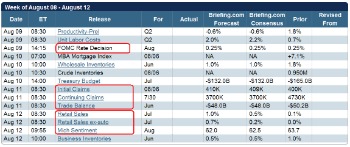

Traders can use pips to measure a potential take-profit target on trades as well. In 50 PIPs a day forex trading strategy, traders open and close several positions in one day instead of investing money for the long term. This is suitable for day traders as they invest money with the purpose of making short term profits regularly. This strategy helps in capturing at least 50 percent of the price range in which the forex currency pairs move in one trading day. Now you should know the answer to the question “what is a pip in forex trading?

If you are a beginner, we recommend opening a demo account at a forex broker to get yourself familiarized with forex trading without the risk of losing money. The foreign exchange market is the largest financial market in the world. With a daily average volume of about $6.6 trillion and worth over $2.4 quadrillion as of 2021, Forex is a decentralised global market for trading currencies. The currency pair USD/JPY is the only exception when it comes to calculating PIPs in forex. Whenever any major currency is traded against the Japanese currency, pips are not the fourth decimal in the calculation but the second decimal. This is due to the extremely low value of the Yen when compared to other major currencies.

What is a pip in stocks?

Fractional pips are smaller than pips and, thus, a more precise measurement. They appear as a superscript numeral at the end of a quoted exchange rate. Forex currency pairs are quoted in terms of pips, short for percentage in points. Most currency pairs are priced out to four decimal places and a single pip is in the last decimal place. A pip is thus equivalent to 1/100 of 1% or one basis point.

Fractional pips can allow for tighter spreads, and give a better understanding of a currency price’s movements. You measure pips in Forex by watching the exchange rate’s movements. Most currency pairs use the four-decimal style, so a one percent change would be equal to one pip.

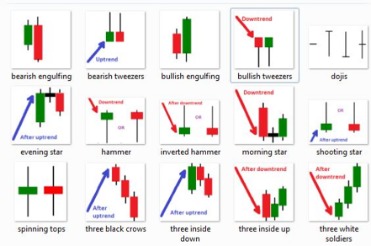

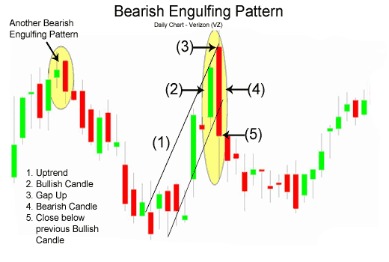

Learn more about developing your own forex trading strategy, such as swing trading, day trading and forex scalping. Before blindly jumping into the exciting world of the markets, it is important to properly educate yourself on the vocabulary and concepts that will accompany us daily on your trading journey. Indeed, new traders can be easily overwhelmed as they first enter the markets, and this brief lesson is aimed to help them along the way.

We use the information you provide to contact you about your membership with us and to provide you with relevant content. Let’s take an example and stick with our two what are pips in forex trading – the GBP versus USD. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination.

Harness the market intelligence you need to build your trading strategies. Deepen your knowledge of technical analysis indicators and hone your skills as a trader. Given the complexity of forex industry, some brokers are issued legal licenses by cheating regulation institutes. If the data published by WikiFX are not in accordance with the fact, please click 'Complaints 'and 'Correction' to inform us. Forex pips are much more interesting once you go further, and they clearly share some distinct characteristics.

To calculate the value of a pip you must first multiply one pip (0.0001) by the lot or contract size. Standard lots are 100,000 units of the base currency, while mini lots are 10,000 units. If you are new to the world of forex trading, you may be wondering what a pip is. Short for "points in percentage", pips are the smallest incremental move that a currency pair can make.

USDJPY fluctuates as traders react to oil cut news: Key support and resistance levels - ForexLive

USDJPY fluctuates as traders react to oil cut news: Key support and resistance levels.

Posted: Mon, 03 Apr 2023 13:35:00 GMT [source]

However, there is an exception to this rule when dealing with the Japanese Yen. While trading the yen, you’ll have to look at the second decimal place instead of the fourth, because this currency is much closer in value to one hundredth of other major currencies. Let’s look at an example to put this difference in perspective.

Please ensure you fully understand the risks involved by reading our full risk warning. TTo do this, you need to multiply the point value by the number of fractional pips in a profitable trade. Next, the resulting value should be converted into the currency of the trading account based on the current exchange rate. Note that trading on the foreign exchange market comes with high risk, thus it’s crucial to continuously educate yourself and develop a robust Forex trading strategy.

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164x164.jpg

However, if the USD is the first number in the pair , the pip value will involve the exchange rate, such as USD/CAD. In this case, you must divide the pip size by that exchange rate, multiplying that number by your trade value. 77.93% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

The EUR/USD Currency Pair: Ins and Outs of Trading - Parsippany Focus

The EUR/USD Currency Pair: Ins and Outs of Trading.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

For example, when trading EURUSD the pip value will be displayed in USD while trading EURGBP it will be in GBP. The number of pips that can be considered a good trade will depend on a range of factors, including the trading strategy you are using and your trading experience. If a trader’s combined position sizes are too large and they experience a number of losses, their capital could be wiped out. Therefore, trading with an appropriate position size is essential. With stock trading, pips are very rarely used as a term to define price movement since the shifts in stock prices move far more aggressively then they do in the foreign exchange market.

For most currency pairs, the fourth digit after the decimal point in price quotes represents a pip. The only exception is the Japanese yen, for which the second digit after the decimal point in the price quote denotes a pip. The second formula is used for those pairs that use Japanese yen as a base currency. The change in, say, the USD/JPY pair is so rapid that the above-mentioned method would generate thousands of pips. Instead of that, the industry has established an alternative method that uses the second number after the decimal point to determine a pip.